Markets Rattle as $150 Billion in Forced Selling Hits Trading Floors

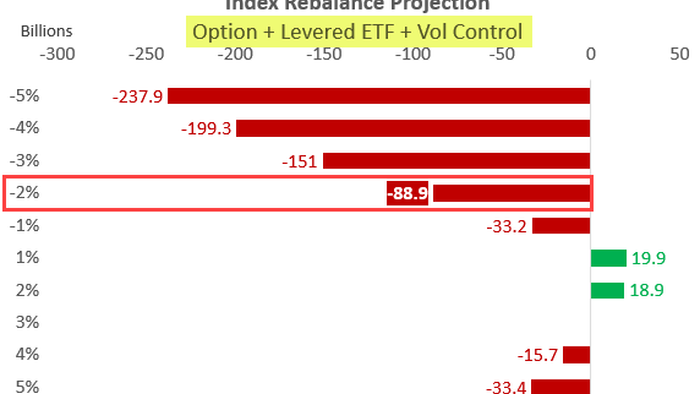

A sudden wave of forced selling amounting to $150 billion sent global financial markets into a frenzy today, alarming investors and prompting widespread uncertainty about the resilience of current asset prices. The sharp drop, highlighted by sharp declines across multiple sectors, reflects deepening concerns about systemic vulnerabilities in the face of rapid liquidations.

Key Takeaways

- A massive $150 billion in forced selling triggered volatility across major financial markets.

- Institutional investors and funds faced liquidation requirements, exacerbating market moves.

- Analysts warn of potential knock-on effects if selling persists into the coming weeks.

What Triggered the Forced Selling?

According to leading financial analysts, the forced selling was prompted by margin calls as markets corrected sharply in response to recent macroeconomic shocks. With some asset classes experiencing swift devaluations, leveraged investors—including hedge funds and pension funds—were forced to liquidate large positions to cover losses or meet collateral requirements. The sudden demand for liquidity accelerated price declines, further triggering algorithmic sell orders and compounding losses.

Impact on Major Asset Classes

| Asset Class | % Change (Estimate) |

|---|---|

| Equities | -4% |

| Corporate Bonds | -2.5% |

| Real Estate Trusts | -3.1% |

| Commodities | -1.7% |

Stocks bore the brunt of the selloff, with major indices falling sharply and high-yield credit markets also coming under pressure. Real estate investment trusts and commodity markets such as metals and oil were not immune, experiencing significant declines.

Broader Economic Concerns

Economists worry that today’s forced selling could signify deeper liquidity stress within the financial system. If large funds continue to face redemptions or margin pressures, additional bouts of volatility may be ahead. Some experts compare the dynamics unfolding today to past episodes of forced deleveraging, cautioning that further policy intervention may be required if contagion spreads.

What’s Next For Investors?

Investors are urged to remain cautious and closely monitor market developments. Experts recommend:

- Reducing leverage and reviewing exposure to volatile asset classes

- Maintaining higher cash allocations until stability returns

- Keeping a close eye on fund redemption notices and liquidity positions

With the full impact of today’s events still unfolding, market watchers will be keenly focused on both policy responses and any signs of renewed stability in coming days.

![[Donald Trump] sues [Hillary Clinton] over Russiagate lawsuit.](https://countrybrief.com/wp-content/uploads/2025/11/thumbnail-132-768x432.jpeg)